New Markets Tax Credits

The New Markets Tax Credit (NMTC) program fuels community-impact projects by incentivizing private investment in economically-distressed communities.

As a certified Community Development Entity, AltCap has been awarded nearly $220 million in NMTC allocation and has facilitated more than $250 million in NMTC transactions in Missouri and Kansas.

We also provide comprehensive consulting services, ranging from educational sessions and allocation sourcing to transaction management and compliance.

VISION

We believe the NMTC is a tool that — when used purposefully — can create a transformative ripple that benefits communities. Our goal with NMTC financing is to support job-creating businesses and advance catalytic real estate development projects that promote economic opportunities and enhance neighborhoods.

INVESTMENT

AltCap has facilitated $250+ million in NMTC transactions — contributing $213 million in allocation that has been awarded by the CDFI Fund — in Missouri and Kansas. We’ve helped rehabilitate or construct 2.6+ million square feet of real estate, create thousands of jobs, and deliver $65+ million in tax credit equity to 28 borrowers.

IMPACT

The NMTC Program fuels job-creating business investments and catalytic real estate projects by incentivizing private investors with a federal tax credit. For every $1 in Federal tax credits, the NMTC Program generates $8 of private investment.

NMTC Consulting Services

With more than 15 years of experience as an award-winning Community Development Entity, AltCap supports businesses, real estate developers and nonprofits leverage New Markets Tax Credit financing.

We offer comprehensive consulting services to assist developers, business owners and their stakeholders at each stage of the process.

Project evaluation, eligibility and community impact assessment

Due diligence and NMTC allocation sourcing

Leverage loan sourcing

Transaction/finance structuring and negotiation

Closing process

Post-closing compliance

Contact Chris Vukas at cvukas@altcap.org to learn more.

How NMTC works for you

Administered by the CDFI Fund, the NMTC Program stimulates investment and economic growth in low-income communities that lack access to capital.

AltCap is a recipient of NMTC allocation from the CDFI Fund, which allows us to provide tax credit facilitated financing directly to businesses, and/or leverage our expansive network of partners to source NMTC allocation from other CDEs.

Sign up for our newsletter to be notified of award allocations and opportunities to apply for financing.

-

• Businesses Ownership. Applicants can be for-profit or not-for-profit

• Geographic. The business must be located in a low-income census tract.

• Business type. The business must NOT be one of the following, 1) Gaming, 2) Farming, 3) Liquor Store, 4) Massage Parlor, 5) Golf Course, or 6) Non-mixed-use rental housing

-

• Below market interest rate

• No origination fees

• 84-month interest-only payments

• Average LTV of 125%

• Non-traditional collateral: unsecured debt, negative pledge agreements, pledge of membership interest or collateral on non-related assets

• Lower than standard DSCR: 1.0

• Subordination when required by senior sources

-

Proposed projects should provide some of the following community impacts:

• Living wage jobs with benefits

• Be a minority-owned business

• Workforce development/on the job training

• Community services provided to low-income people, such as healthcare, childcare, substance abuse treatment, education, etc.

• Commercial goods and services provided to low-income people – healthy food, business incubation, commercial kitchens, etc.

• Below-market rental space

-

NMTC lenders operate on an annual cycle. They receive allocations of tax credits in the fall/early winter and look to deploy the credits to eligible projects the following year.

It is never too early to reach out regarding a project’s eligibility and attractiveness for NMTC facilitated financing. Contact Chris Vukas to learn more cvukas@altcap.org.

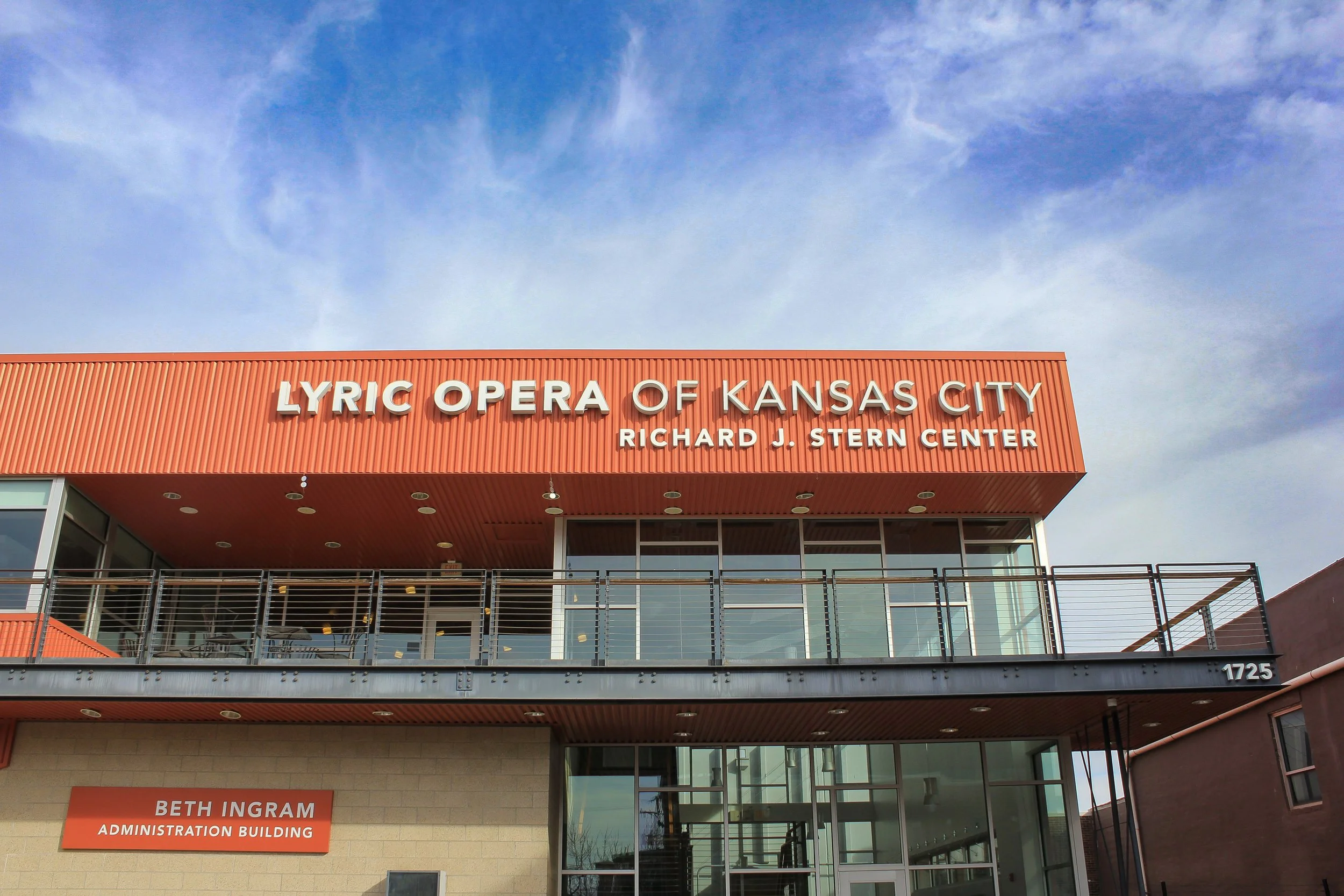

Featured Projects

SCHEDULE A CALL

AltCap can help fuel your community-impact development project. We are available to provide direct answers and expertise tailored to your needs and your project. Complete this form to begin the conversation.

ALTCAP NMTC PORTFOLIO

Articles for Entrepreneurs Exploring Small Business Loans

Frequently Asked Questions

-

As a mission-driven Community Development Financial Institution (CDFI), AltCap can often overcome traditional lending constraints. Challenges like previous denials, credit scores, bankruptcy, and limited collateral, may be overcome by other positive aspects of your business, like community impact, additional guarantors, or other sources of revenue. We’ll work to understand your needs and create solutions to help you grow your business.

-

Yes. We lend capital to small businesses regardless of their industry, size, or stage of growth. Owners of startups will be asked to provide a business plan, financial projections, and other documentation in lieu of historical financial statements.

-

No, AltCap does not offer depository services or consumer banking products, but we have other local CDFI and banking partners who can serve your unique needs. Visit the KC CDFI Coalition or speak to your Business Development Officer to learn more.

-

AltCap and its affiliate, AltCap California, serve entrepreneurs in California, Colorado, Kansas, Missouri, Nebraska and Texas.

-

Yes. We understand that your business has unique needs and while you work hard to be resourceful, challenges can arise. We will accept applications from businesses with up to two active loans and at least six months of payment history. Our team will work with you to assess your ability to take on new debt and what collateral may be available to support your needs.

-

AltCap can provide entrepreneurs $5,000 to $250,000 in debt capital to launch, operate or grow their small businesses. Proceeds may be used to fund equipment, marketing, payroll, services, capital expenses, and more. The amount you can borrow will depend on your capital needs and your ability to cover the debt service.

-

Collateral is not always required of our borrowers but providing collateral may help you access better loan terms. Discuss your collateral options with your Business Development Officer. UCC’s are required for all business loans.

-

No. AltCap does not require a minimum credit score for most products. We work with you to understand the circumstances of your credit and evaluate it alongside your financials, management abilities, and growth potential.

-

Our goal is to provide capital in a timely manner. On average, an AltCap loan can take 30-45 days from application submission to credit decision to complete. Questions or challenges may arise as we review your documents, and it is critical that you provide a timely response to keep the analysis and underwriting process moving.

-

In addition to accessible capital, AltCap provides other business support and services to our clients. We also collaborate with other lenders and business advisors to provide you with the support you need to start, grow, and sustain your business. Talk to your Business Development Officer about your options and visit our affiliate organizations, equity2 and Community Capital Fund.